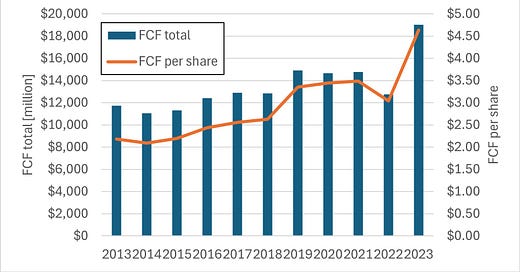

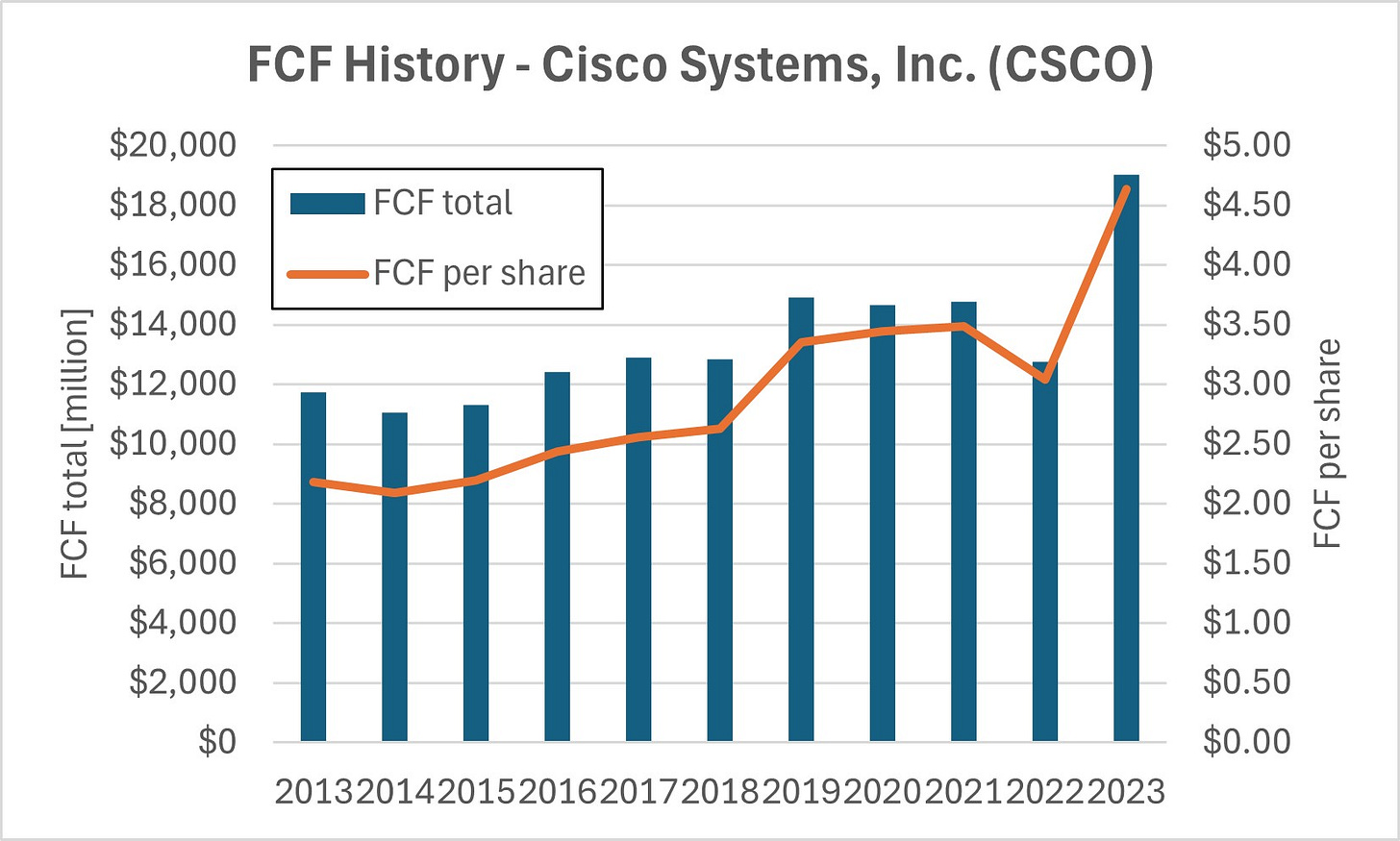

Company profile: From 2013 to 2023, Cisco Systems, Inc. (CSCO) grew its total free cash flow (FCF) from $11.7B to $19.0B (4.96% CAGR). Sizeable share repurchases caused its FCF per share to increase even faster from $2.18 to $4.64 (7.84% CAGR).

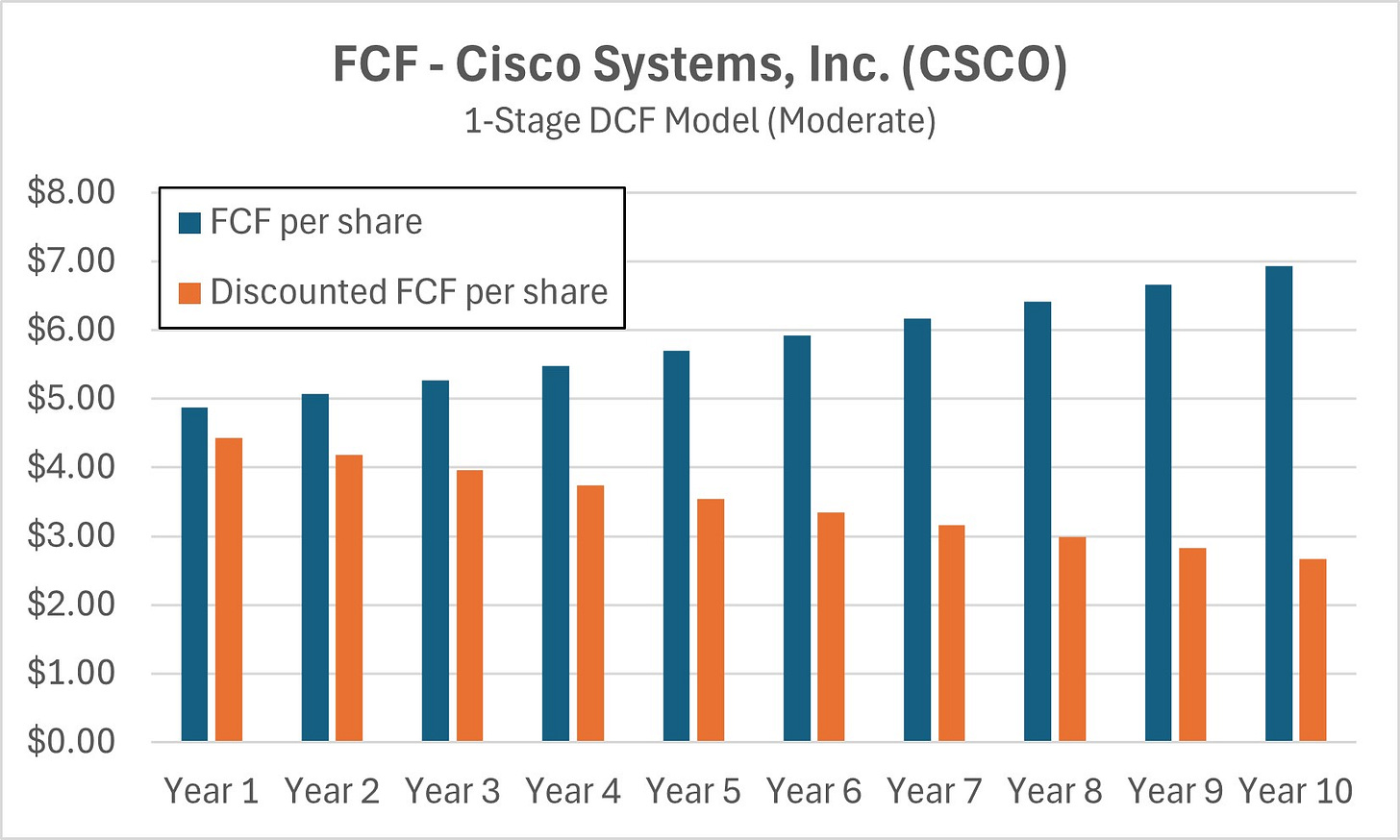

1-stage DCF model: The 1-stage DCF model assumes that both the FCF growth rate g and the discount rate d remain constant in perpetuity. The intrinsic value IV equals:

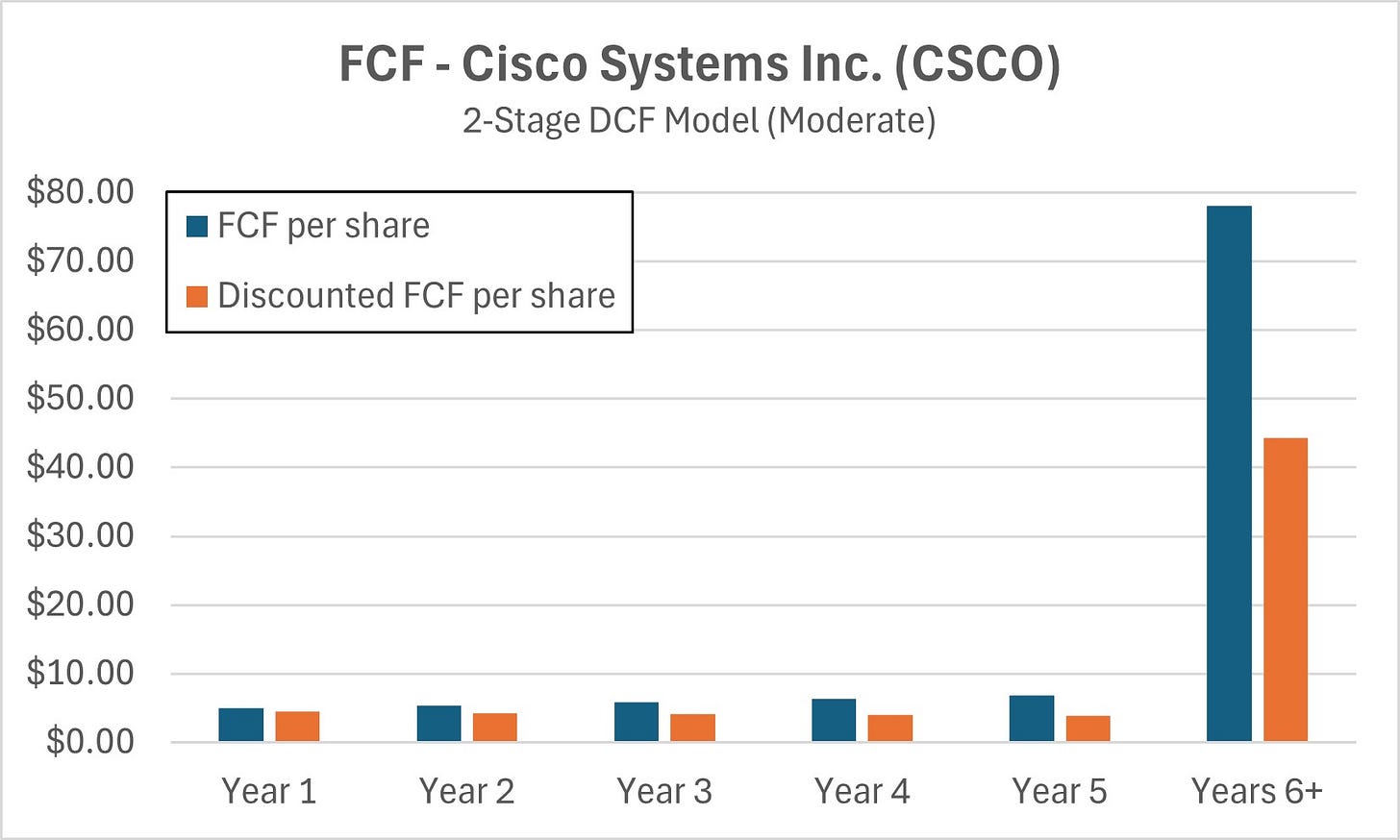

2-stage DCF model: The 2-stage DCF model assumes an elevated initial FCF growth rate gi during the forecast period of n (typically 5) years, followed by growth at a lower perpetual rate gp starting in year n+1.