Mortgage Qualification Based on Front-end and Back-end Debt-to-Income Ratios

Article of the week

Dana George (Motley Fool): What Is the 28/36 Rule and How Does It Affect My Mortgage?

Core Ideas

1) Front-end ratio: The front-end DTI ratio is defined as housing expenses (mortgage principal & interest, property taxes, private mortgage insurance (PMI), homeowners insurance, homeowners association (HOA) fees) divided by gross income.

2) Back-end ratio: The back-end DTI ratio is calculated by dividing all debt servicing expenses (installment: home, student, auto, personal loans; revolving: credit card, home equity line of credit (HELOC), other: child support, alimony, medical debt) by gross income.

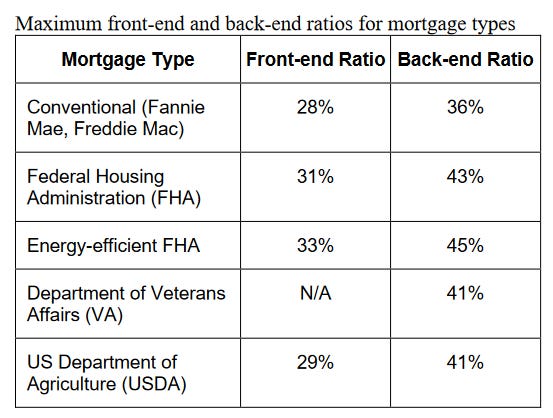

3) Mortgage types: The DIT ratios for conventional (Fannie Mae, Freddie Mac) mortgages are limited to 28% and 36%, respectively. Other government-backed lenders offer mortgages to borrowers with higher DTI ratios.