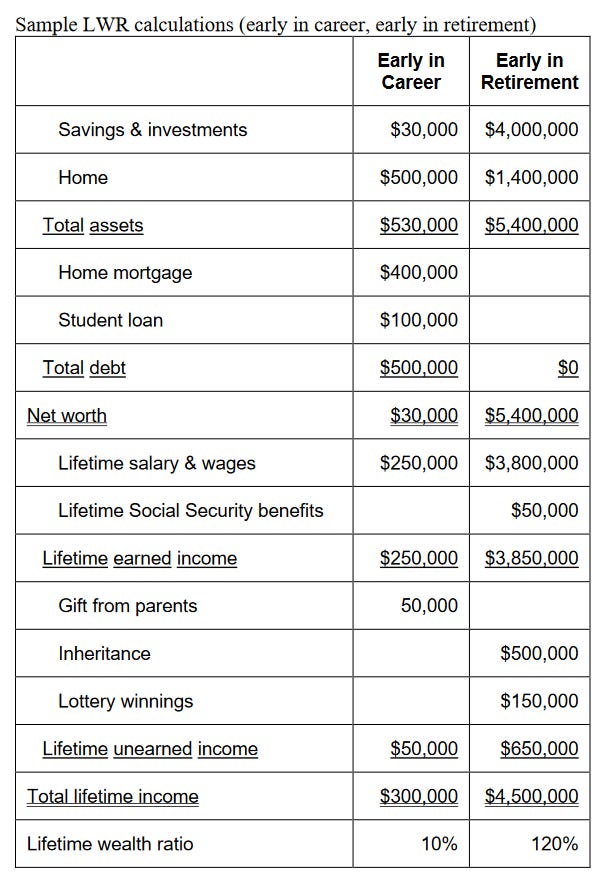

Lifetime Wealth Ratio Calculation

Example of the week

LWR lifecycle: Early in life, net worth is raised mainly by saving a fraction of earned income. Later in life, after accumulating significant investments, savings from earned income pale in comparison to investment returns.

LWR improvement: Initially, LWR increases are driven by the savings rate and a high LWR is indicative of prudent spending and debt usage. Later, the investment rate of return becomes the dominant factor and a high LWR is proof of investment success.

LWR fluctuations: Investors with large stock portfolios must tolerate significant temporary reductions in their LWR during frequent and unavoidable market drawdowns.